Xiaomi vs. Samsung – are we in for a period of dominance of Chinese manufacturers?

Just a few years ago, Nokia fought with Apple for the title of leader in global smartphone sales. Today, the Finnish telecom legend no longer produces its own phones, and for some time we have been witnessing the expansion of Chinese manufacturers of these devices. In recent days, there has been another change, confirming the trend.

China's Xiaomi sold more smartphones than Samsung and became the leader in its home market.

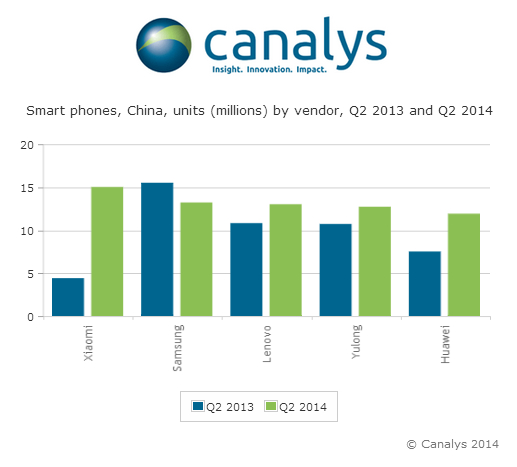

According to a recent report by analytics agency Canalys, Xiaomi gained 14% Chinese market share in the second quarter of this year. The previous leader, Samsung, has dropped to second place, gaining 12%. Xiaomi's success is impressive, as in just one year it has increased its sales levels by 240%.

China – a sales paradise, but only for a select few

The smartphone market in the country of the Middle Kingdom is of great importance for a very simple reason – it is the largest in the world. China sells 108.5 million devices, which represents 37% of the global market. Importantly, as many as 70.7 million phones bought by the Chinese are of domestic manufacture.

Samsung and Apple (the only multinationals among the top 10 manufacturers operating in the Chinese market), ship 20 million devices, accounting for just 18% of the market.

Market in the shadow of Chinese manufacturers?

In addition to Xiaomi, the largest smartphone manufacturers in China are Lenovo, Huawei, BBK, ZTE, OPPO and K-Touch. Some of these companies are present at the top of the international market, with sales of 292.4 million devices in the second quarter of 2021, an increase of 23% Compared to the same period last year.

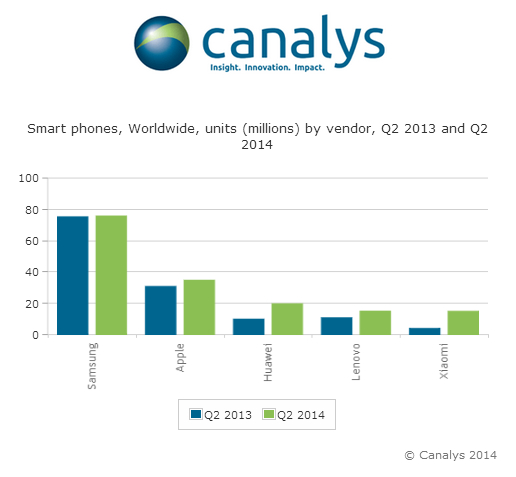

The fact is that it's Samsung that has dominated the mobile device industry for several years, but its shares have been gradually declining. In the second quarter of this year, the South Korean corporation reached 26% share of the global smartphone market, but in the same period of 2021 it was as high as 32%. A decline of 6% Xiaomi vs. Xiaomi in just a year is quite a problem for Samsung's mobile division.

Although Samsung's lead over second-place Apple (12% of global market share) is still "secure," further expansion of Chinese manufacturers could reshape the entire industry in the future. The third, fourth and fifth smartphone manufacturers in the world, respectively – Huawei, Lenovo and just Xiaomi – are Chinese companies that jointly control the 17% of the global smartphone market.

From west to east… and back again?

The world's mobile device manufacturing center has long been moved from west to east. All major mobile equipment manufacturers are Asian companies, with the only exception being Apple, which competes not only with other hardware vendors, but also with the Android and Windows Phone system platforms.

Chinese manufacturers are aware of the need to go beyond their home market. Today, as much as 97% of Xiaomi's sales and 84% Lenovo is being pursued internally. However, the Middle Kingdom's major manufacturers are expanding distribution networks for their hardware.

One example is Xiaomi, which wants to start selling its handsets in Indonesia, Mexico, Russia, Thailand and Turkey by the end of the year.

A new trend, and a major change as a result

Will Samsung's place be taken in a few years by a Chinese manufacturer's? Well, this is not an impossible scenario. However, prevailing standards and consumer expectations in developed country markets are different from those in China. For many potential users, the inscription "Made in China," combined with a brand name that doesn't say much, can be an obstacle in the decision to buy a Xiaomi model instead of another Samsung, Apple or Microsoft handset. Of great importance is the manufacturer's support, service facilities, software updates or the belief that the products of a given manufacturer are of good quality and safety.

All this takes years to work on.

At the moment An aggressive sales policy, combined with a very good price/performance ratio and quality of devices (an example being the Xioami Mi 4 and the company's wristband we described), suffice in achieving better and better sales results. It remains an open question when Chinese companies will have to invest considerable sums of money for marketing activities, developing distribution networks or technical support. Won't the associated increase in device prices put the brakes on the "Chinese storm" in Western markets? The only advantage of Chinese products over the others, is their very competitive price.